BUYING

Is your credit card coverage enough?

In this article, we'll explore:

- A quiz to test if you'll be covered, or on the hook for damages

- Scenarios where your credit card will deny your coverage

- Other scenarios where you could be on the hook for $100,000’s of dollars

- The 2 other forms of auto coverage your credit card insurance doesn't provide

Last Updated Aug 20, 2024

10 min read

Quick facts

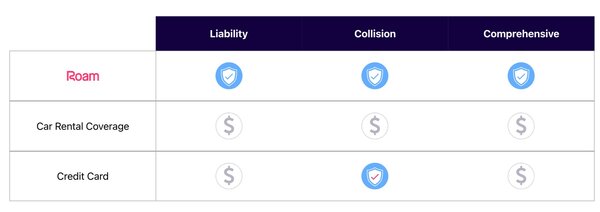

- There are 3 components of auto insurance coverage: Liability, Comprehensive, and Collision.

- Credit card coverage only provides collision coverage (1/3 recommended coverages)

- Liability claims (not covered by credit cards) represent the highest claim amounts

⚠️ Your credit card coverage isn’t valid in these scenarios

Vehicle was rented and kept for over 45 consecutive days

Most credit cards have a clause that limits coverage to a 29 - 45 day period, depending on the vehicle. If you have rented for longer than the term limit on your credit card, your coverage will be denied and the claim won’t be honoured. This means you would be fully responsible for the cost to replace the vehicle and pay for damages. With a regular rental company, you will be limited to a 30 day term, and be forced to physically revisit the rental counter to begin another contract.

Pro tip: Even if the vehicle was rented across two separate 30 day contacts, your credit card invoices will show consecutive usage, and if you get into an accident in your second month you will probably be denied coverage. There are many cases where customers have tried to outsmart their card providers, however keep in mind the insurance business is set up to pay out as little as possible!

Someone else was driving and got into an accident

If anyone but the cardholder is driving the vehicle and gets into a collision, the credit card insurance claim will be denied. This becomes challenging when there are police reports that need to be filed, and it will ultimately impact your driving record. The accident would show up on your insurance history and you could be left on the hook for thousands of dollars of unpaid coverage, plus an increase in premiums due to the accident on your driving record.

⚠️ 💸 You will be financially responsible for damages in these scenarios

Reality can add up quickly if you don’t have the right coverage

You hurt yourself and require medical care

You are not covered. Credit card coverage does not cover any physiotherapy, rehabilitation, or hospital bills, If you are not on a health insurance plan you will incur additional costs that can easily exceed your basic health insurance plan limits.

You are unable to work after the accident

You are not covered. Income replacement will not be covered, even if you are unable to work after your accident. If due to ongoing health challenges or find yourself permanently disabled, you will not receive any kind of financial assistance from the ‘credit card’ coverage.

You injure or kill someone else

You are not covered. This is considered liability coverage, which your credit card doesn’t provide. Assuming ‘credit card’ insurance alone, you will be liable for the full responsibility of all medical damage, loss of income, and damage to another driver or human. This can result in lawsuits that could exceed millions of dollars, and you will be financially responsible for managing the legal bills, and the consequences all on your own. You will receive no reimbursements and there are scenarios where drivers have been forced into bankruptcy because they are unable to pay for the damages and legal bills. Insurance for a few hundred dollars a month is a way better solution!

You damage someone else's property

You are not covered. This is considered liability coverage, which your credit card doesn’t provide. Whether its another bike, building, someone’s items, or another parked vehicle or city property, you will be on the hook for the full amount. Same as the above scenario, you are fully responsible for the financial cost of any damages or repayment required as a result of the accident. In scenarios where coverage hasn’t been purchased, this can result in financial devastation to a driver, or bankruptcy due to $1000’s in damage.

Fire, Hail, & Vandalism

You are not covered. This is considered comprehensive coverage, which your credit card doesn’t provide. Damage to your vehicle from fire, hail, flooding, and vandalism will not be covered. Flooding around Toronto is common, and water damage from backed up roadways is enough for a claim to be denied from insurance!

You are not covered. Vandalism such as broken windows and vehicle scratches would also not be covered, which can result in $1000’s of dollars in replacement parts and body work. Having insurance for $200 is the way to go here. Why take the risk!?

Theft

This is considered comprehensive coverage, which is only covered by a select few credit cards. If your card doesn’t provide coverage here, you are responsible for the full amount of the vehicle, or a big deductible amount which could cost upwards of $5000. Taking insurance for $200 a month is a much safer bet!

–

Without coverage from Roam’s policy, or an active auto insurance policy, all of these scenarios will result in way higher costs than just opting for insurance!

Try a Roam Car Subscription today

Book your first car subscription in minutes and leave the burdens of traditional car ownership behind.